Home Insurance Claim Filing in Today’s Economy

Now about filing a home insurance claim against your insurance provider. With the ridiculous artificially over-appraised values of homes in Texas come outrageous insurance premiums and deductibles. Premiums have doubled and even tripled in the last 3 years at an unprecedented rate.

Artificially over-appraised home values have increased insurance deductibles by double and triple. The 1% deductible is barely the norm now with 2%-5% being pushed onto desperate homeowners trying to decrease their premiums.

The homeowner who just until recently owned a home valued at 200K with a 1% deductible, roughly two-thousand dollars. Now that same home is appraised at 400K, raising the deductible by four-thousand dollars. But wait, the premiums are too high, so the owner reduced the premiums by agreeing to a 2% or even 3% deductible. Now the homeowners are responsible for paying out eight-thousand or twelve-thousand dollars for filing a home insurance claim. See where this is going?

The point here is if you cannot afford your deductible, do not file a home insurance claim. Find out what your part is from the policy and remember that this is what you will owe for a totaled roof claim. Once you start the home insurance claim with the adjustors and claims department there is no turning back. Your insurance will expect the scope of work to be done as well as your mortgage holder and each may demand it to continue roof coverage.

Unfortunately, no company can “cover” your deductible especially since the deductible can be triple or more than the profit margin. This is the world we live in.

Home Insurance Claim Fraud

Plus, any roofing company or homeowner manipulating to have deductibles “covered” can face very stiff fines and imprisonment when caught. Texas Law HB 2102, which went into effect September 1, 2019, requires homeowners to pay the full insurance deductible per their property insurance policy.

Based on the amount of insurance fraud, this is a Class B misdemeanor to a felony, which will be charged to the contractor and whomever signed the contract representing the home policy.

During an audit of a roofing company, these infractions will be found. If proven fraud was committed, all parties to that contract can be charged.

This can be found in the Insurance Code Section 1. Subtitle F, Title 5, Insurance Code, amended Chapter 707. Section 707.002. And in, Section 2. Section 27.02. Business & Commerce Code. Also, Sections 707.001 and 707.004 Insurance Code.

Hail Storms in Texas

It is hail season again, and in North Texas, it is the norm to expect it somewhere in nearly every county. The suburbs continue to grow, building out, and reaching into rural areas. In almost every storm, weather forecasters become rockstars while reporting coverages of places that were once farms, ranches, and cattle pastures but are now covered by tens of thousands of homes.

First, let’s go over Hailstone size 101

Every storm can produce hail, and a homeowner will experience the pounding on their roof. It could be any size from pea to golf ball to baseball. The latter is what everyone worries about. Small hail will not damage roofs on most occasions unless it is blown by hard winds, and lasts 30 minutes or more. Most of the time, it is over in a couple of minutes or less.

In the case of prolonged wind-driven hail, it will not cause large noticeable impacts or leaks but will strip the granules from the shingle surface. This can cause issues years later on since the asphalt adhesive will be exposed to sunlight. It can deteriorate quickly exposing the fiberglass backing which can result in leaks.

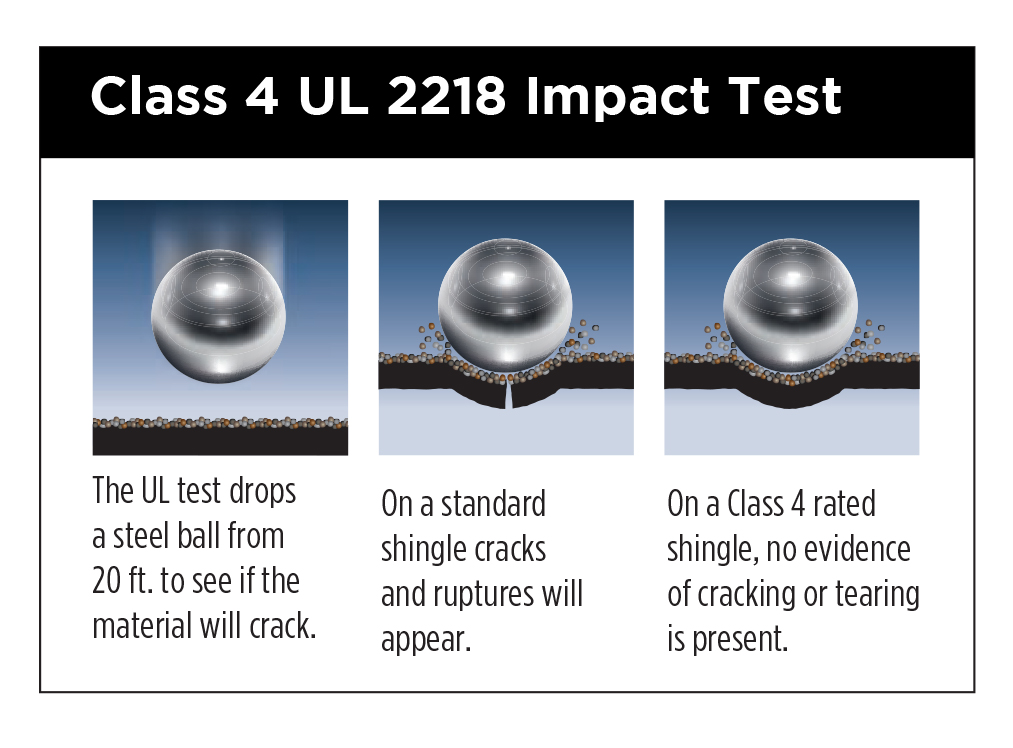

Regarding pocket-change hail (1/2”–1 ¼”), most shingles today will resist impacts unless it is an old shingle. The older the shingle, the weaker the material wears out. If it is blown by hard winds the same striping of granules can happen more quickly.

Next is the dreaded 1 ½”–2 ½” and larger, which leaves deep impacts and can punch through shingles and dent decking. These will flatten out metal roof vents and put holes through plastic vents. Although you may see 3, 5, or 10 golf ball sizes in your yard, it will not mean your roof is totaled. It probably isn’t. Roofs may have a couple of hits or even a handful, but this does not constitute a totaled roof. If your yard is covered with this size and it looks like an armadillo has been digging everywhere, you can bet your roof will be the same.

Shingles Upgrade

For homeowners whose shingles are Class IV or even many of the new Class III hail-resistant shingles, most 2” and smaller hail will bounce off. Vents will still be damaged, bent, and cracked but the shingles will hold up. Better reason. Would you rather file a home insurance claim against your policy, paying thousands of dollars for your deductible. or spend only several hundred dollars on upgraded shingles?

Summary:

Our economy is tough nowadays so there is no reason to make it tougher. Use a reputable contractor who is experienced and not just some door knocker walking neighborhoods.

Texas is #1 in hailstorms and home insurance claims which is why insurance premiums are so high.

Fake insurance claims by shady contractors work “hand-in-hand” with shady adjustors to “total roofs” which have zero hail impacts. Or a roof that only had a few or more dozen shingles blown off causing premiums to rise. Much of this is simply homeowner maintenance. All these fake claims add up to higher premiums for everyone in Texas.

The point is, get a second opinion, maybe a third also. File a home insurance claim only if it is the last option and only if deductible funds are available. Homeowners should not try to put contractors on the rail for their lack of preparation and contractors that try to commit fraud or try to pressure homeowners should find another line of work, it’s not worth it.

We live in a free country today, but freedom is not free.